Avalanche vs Solana: The Complete Comparision in 2023

Introduction

While Ethereum may be the grandfather of smart contracts, Avalanche and Solana are two platforms that have emerged as potential competitors to Ethereum.

Despite having a far lower market cap than Ethereum, these two recent platforms have similar functionality but with greater speeds and much cheaper gas fees.

They also have two enormous ecosystems with various dApps in fields like DeFi, NFTs, P2E games, and DAOs.

Avalanche and Solana, both layer 1 platforms, are frequently touted by crypto professionals as ‘Ethereum Killers’ and have bright futures for creators and investors.

This article will look closely at Avalanche vs Solana – how they work, what makes them unique, and their potential for the future. It will help greatly in understanding this article if you have a basic understanding of blockchain technology.

Avalanche

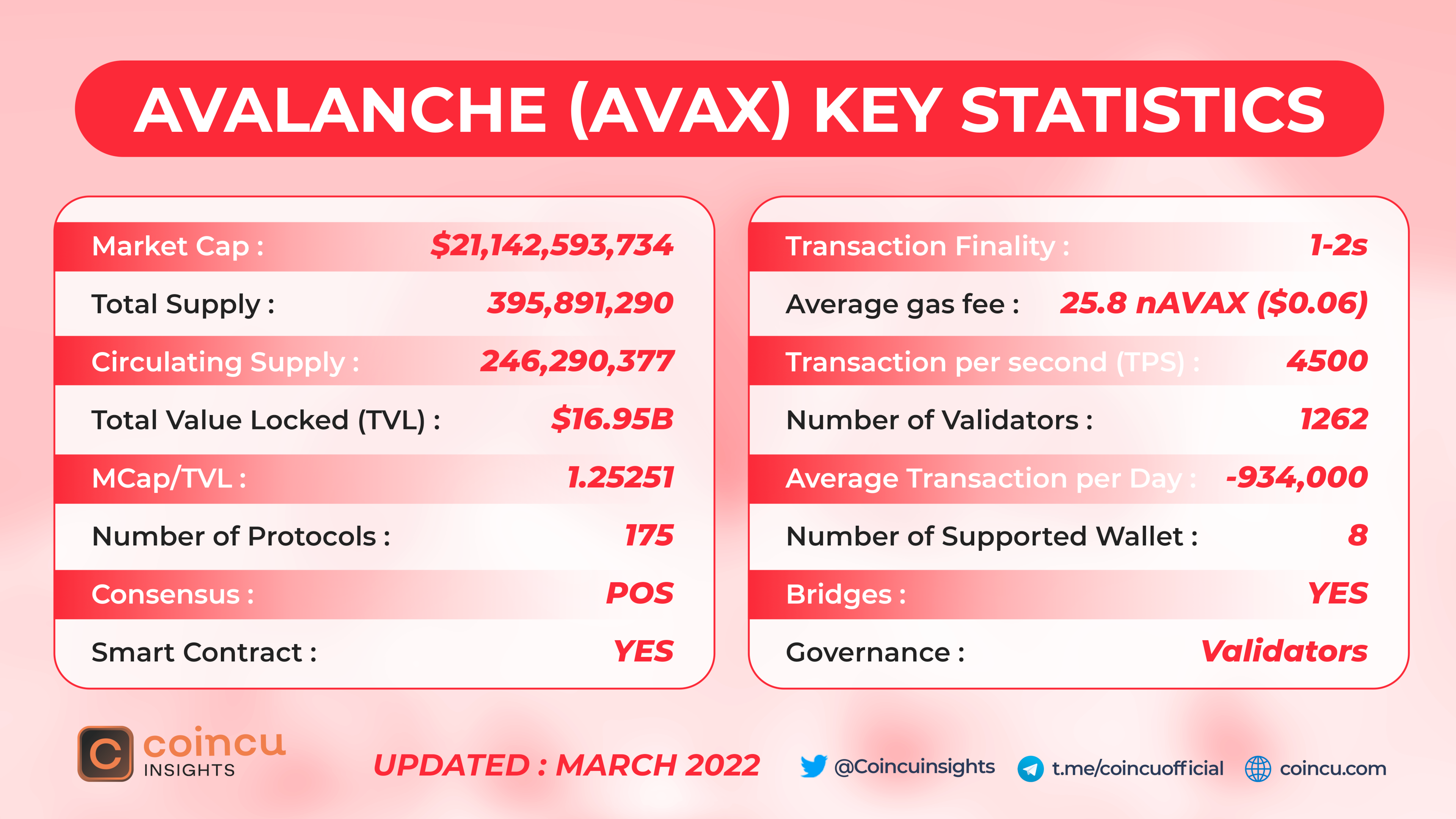

According to information released by the Avalanche team, its network can handle up to 4,500 transactions per second (TPS). This high transactions per second is one of the reasons AVAX has been successful—it is superior to Ethereum, Bitcoin, and even Cardano.

Avalanche’s native token, AVAX, is the ideal setting for decentralized apps (dApps) and private networks. Avalanche is a layer 1 platform. Due to its features, the platform poses a serious threat to Ethereum, the most popular smart contract platform. With the help of these features, the transaction output can increase to 6,500 transactions per second (TPS) without losing scalability.

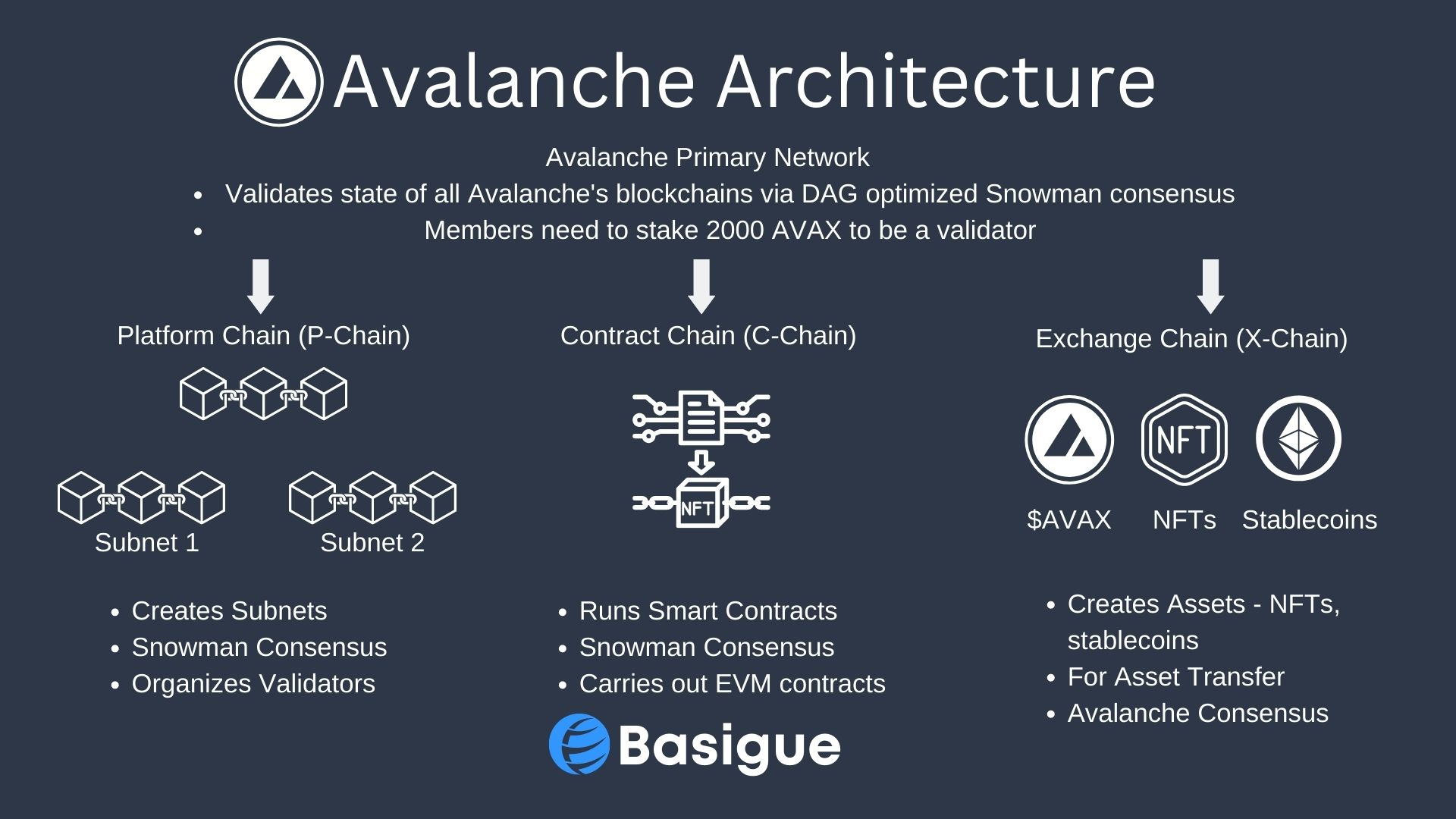

With its unique consensus process, Avalanche offers improved scalability and interoperability. Unlike previous platforms, what drives Avalanche is a combination of three blockchains.

How Does Avalanche Work?

Avalanche uses a consensus that unites three blockchain networks to function as a single DeFi ecosystem. The X-chain, C-chain, and P-chain are three blockchains that each play a unique role in the network.

Contract Chain (C-Chain)

The C-Chain, often known as the “conversion chain,” creates and introduces smart contracts that resemble those found on the Ethereum network.

The chain’s interoperability with the Ethereum Virtual Machine (EVM) enables users to easily convert their Ethereum dApps and take advantage of Avalanche’s capabilities, including improved security and being more scalable.

Aave, an Ethereum-based lending and borrowing dApp, is one of Avalanche’s most well-liked dApps.

The volume of trades and development activities on Avalanche have dramatically increased throughout 2021. Snowtrace estimates that in May 2022, the daily C-Chain transaction volume peaked at 934K.

Exchange Chain (X-Chain)

The X-Chain uses distributed ledger technology to create new digital assets on the Avalanche network and allow asset transfers. AVAX, the Avalanche platform’s native token, enjoys the highest level of adoption.

Users can create new tokens, such as NFTs and stablecoin, by over-collateralizing assets via AVAX. Payment for transaction fees is in AVAX tokens, much like how Ethereum users pay gas fees with Ether (ETH).

Platform Chain (P-Chain)

P-Chain’s design was to allow programmers to build Layer-1 or Layer-2 systems. The chain keeps track of and verifies the status of individual blockchains known as subnets.

Avalanche-powered blockchains can accommodate any need, including developing several blockchains, particularly virtual machines, rule sets, and participation conditions. The Avalanche platform may maintain agility by spreading tasks across various chains. AVAX can also be staked on the P-Chain by validators.

The Consensus Protocol

The technique used by validators in Avalanche is known as the Avalanche Consensus Protocol. A fictitious group presented it with the pen name Team Rocket, which later changed its name to Ava Labs.

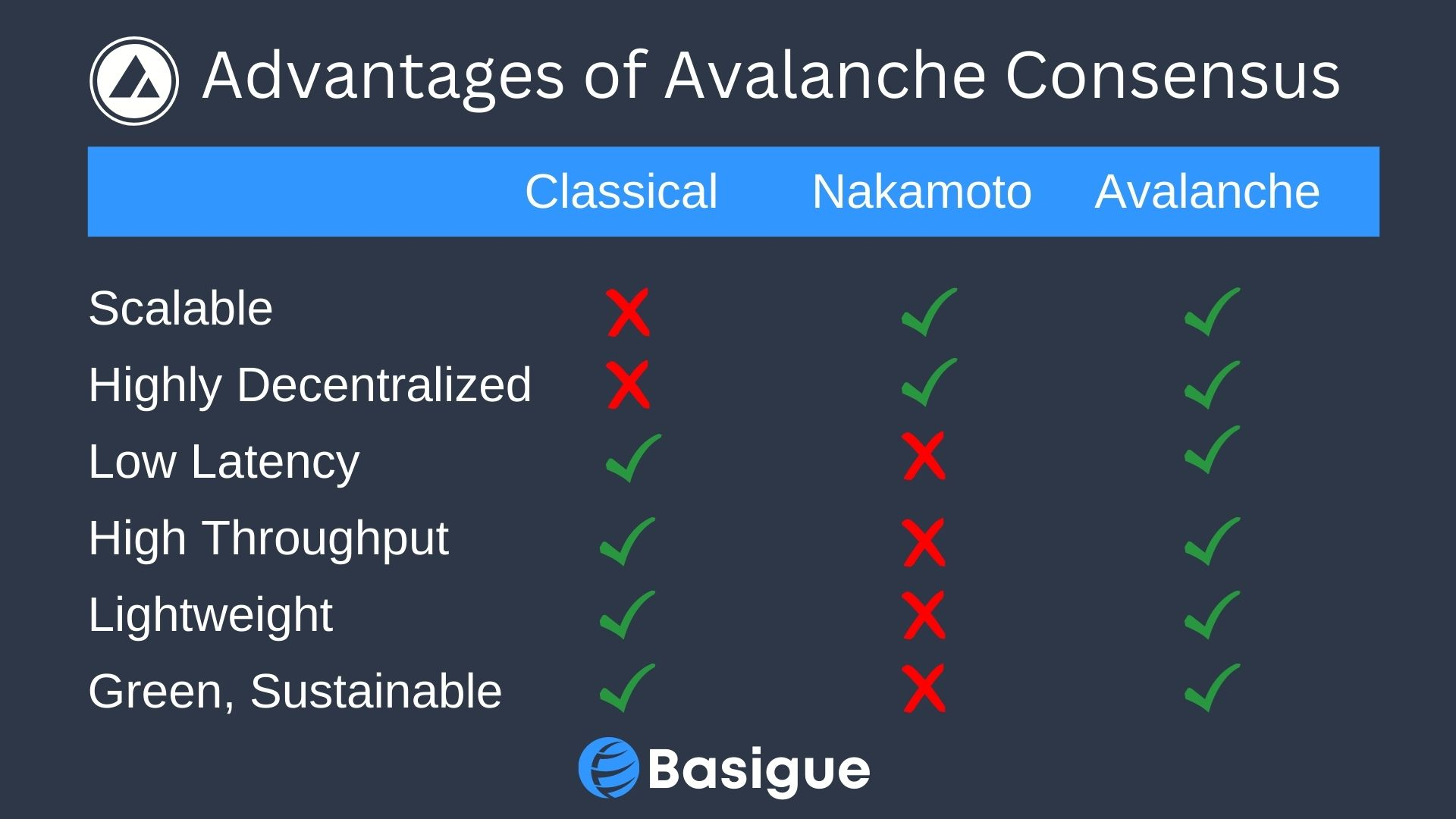

Advantages from Classical and Nakamoto Protocols

The Avalanche Consensus Protocol has advantages from both the Classical and Nakamoto consensus procedures. Although traditional protocols are quick, environmentally friendly, and require minimal, they are typically not decentralized or scalable.

The Nakamoto protocol, created by the famous creator of Bitcoin, Satoshi Nakamoto, offers decentralized, reliable, and scalable platforms. The network’s upkeep is pricey, and records are transacted more slowly.

On the other hand, the method of Avalanche is a type of Proof-of-Stake (PoS) mechanism. Since PoS systems do not rely on miners, they are far more energy-efficient than Proof-of-Work systems. Instead, to add a block to the network, validators stake AVAX.

How does Avalanche consensus work?

The building block of the Avalanche Consensus is known as the Snowman Algorithm. A random group of validators (1400 in total) chooses whether to accept or deny a transaction that the Avalanche protocols have asked for using repeated subsample voting.

This procedure continues until most validators respond consistently in one of two ways (i.e., accept or reject) over a period. In general, a sufficient number of the sampled validators must agree for the transaction to move forward, and the opposite is also true.

If there are no problems, the transactions can be finalized relatively rapidly. Good validators gather around conflicting transactions when they happen to form a positive feedback loop that favors the conflicting transaction until all validators support it.

Key Functions

These are Avalanche’s primary features:

Subnets

A subnet is a customized blockchain with its own set of rules built within the Avalanche P-Chain; it also has its own group of validator nodes. Users can design and construct subnets as needed to suit their needs.

At launch, the subnets remain connected and function as replicas of the P-Chain, akin to sharding on Ethereum 2.0. To handle significant traffic levels and guarantee seamless transaction flow, users can construct another subnet when a subnet hits its scaling limits.

Avalanche Bridge

Between the Ethereum and Avalanche networks, the Avalanche Bridge enables quick and secure transfers of ERC-20 assets. Users of Avalanche can utilize their current ERC-20 tokens on the Avalanche chain, proving the platform’s compatibility. The bridge can also function flawlessly with online wallets like MetaMask and Coinbase wallet.

“Red Coin”: The AVAX Token

The primary utility token for the Avalanche ecosystem is the AVAX coin, popularly referred to as the “red coin” by its owners. The token is usable in several ways, including staking, paying for gas, and collateralizing new assets.

As of June 2022, more than US$33M worth of AVAX had been burnt, according to the tracker website BurnedAvax.

The fee algorithms used by Avalanche were motivated by EIP-1559, the dynamic gas fee model for Ethereum. Avalanche’s gas fee is wholly burned, in contrast to Ethereum, where some of the gas fees go to validating nodes, and there is some burning of gas fees.

Why Avalanche?

Compared to other traditional platforms, Avalanche provides a wide range of advantages. Its most notable benefits include the following:

Scalability

With 1,400 validator nodes in less than two years after its start in 2020, Avalanche Consensus has also massively decentralized its network security.

With its revolutionary system, which can confirm transactions in under a second, the multi-chain design enables the network to scale linearly.

Furthermore, the generation of subnets is limitless, which eliminates the issues of being scalable with traditional platforms.

TPS (Transaction Per Second) typically ranges between 5 and 10 for the Bitcoin blockchain, whereas Ethereum can handle about twice that number. In contrast, the C-Chain has a high throughput of approximately 4,500 transactions per section.

Interoperability

As it permits the establishment of many subnetworks utilizing the blockchain as a common foundation, the Avalanche network is very interoperable.

Avalanche supports ERC-20 token swaps and is compatible with Remix, MetaMask, Truffle, and other Ethereum tools in addition to Solidity smart contracts.

There are only so many platforms built on blockchains that let multiple blockchains exchange assets and data. Fewer can achieve continuous throughput and quick speeds, let alone compatibility with third-party tokens.

Cost Efficiency

Compared to other programmable networks, Avalanche’s costs are among the lowest, and the price of building additional blockchains and assets is meager.

Due to its cost-effectiveness, Avalanche effectively addresses Ethereum’s record-high gas fees brought on by its high levels of congestion.

Following the burning of these fees, fewer AVAX tokens will be available for purchase, increasing demand and driving up the price.

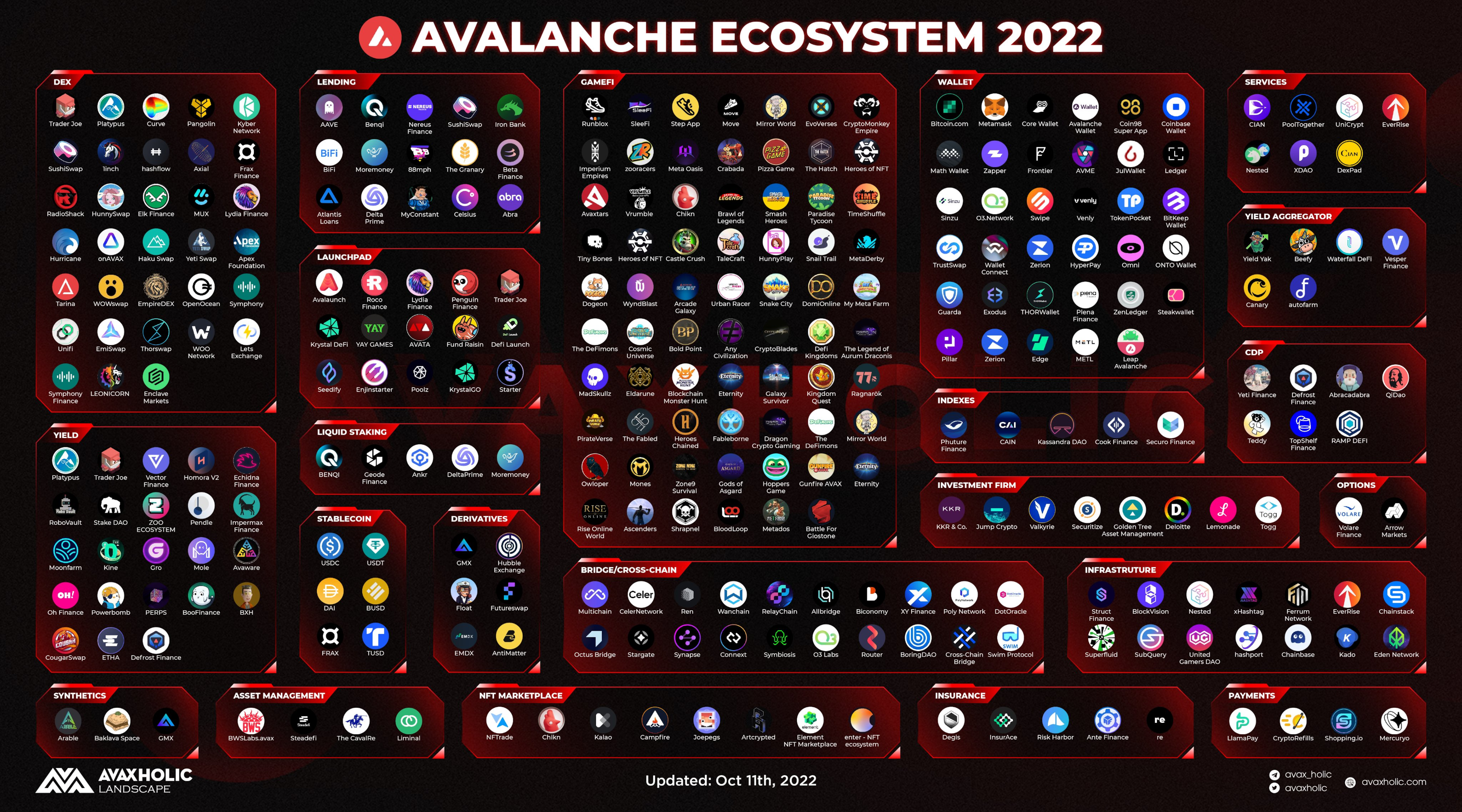

Avalanche Ecosystem

Avalanche’s backward compatibility with Ethereum allows it to support every significant dApp on that platform. As an illustration, Aave is the most well-known lending dApp on Avalanche, even though it is one of the largest lending dApps on Ethereum.

Similarly, Pangolin (PNG) is Avalanche’s equivalent of Uniswap’s decentralized exchange (DEX).

There are currently 278 live projects on Avalanche as of November 2022. The top three Avalanche marketplaces for NFT traders are NFTrade, NFTStars, and Lootex.

It has versions of the most well-liked NFT collections on Ethereum, including CryptoDappers, AvaxApes, and DeFi Dinos. The first race-to-earn blockchain vehicle simulation game with upgradeable NFTs is DCRC-RaceX, exclusively.

The Future of Avalanche

Despite the prolonged crypto downtrend, Avalanche’s future is still bright. In May 2022, the Avalanche network handled over 32M transactions, up from less than 1M just a year earlier. There was a whopping 81% increase in the deployment of individual smart contracts since May 1, 2021. Significant businesses are now using the blockchain technology developed by Avalanche, like Deloitte, Lemonade, and Togg.

Solana

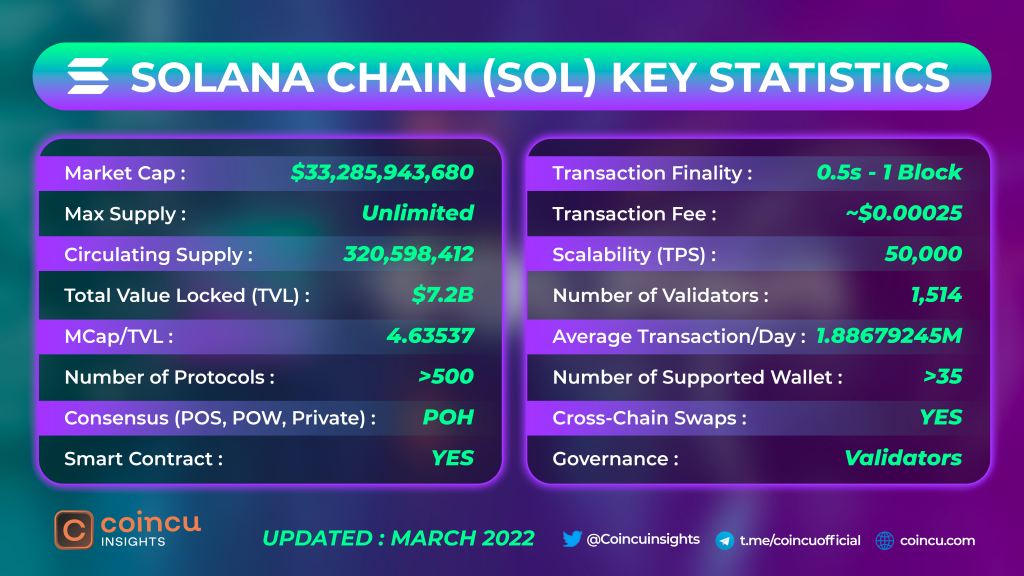

Solana is an open-source, public layer 1 network that supports NFTs (non-fungible tokens) and various dApps. Solana is a blockchain that contains its native token, SOL, a utility token that transfers value and allows the network’s security through staking.

Solana utilizes smart contracts, much like another well-known platform called Ethereum. Smart contracts are codes on a blockchain that run a set of instructions when specific conditions are met. This can be done without the need for a middleman to execute.

But this isn’t the only thing that sets Solana apart.

What makes Solana unique?

The developers of Solana set out to address a few issues they felt were absent from other platforms and conventional financial products, such as:

The creation of Solana was with efficiency in mind. The criticism about the Solana network giving up decentralization to scale, yet this tradeoff appears to have succeeded for Solana, which boasts a theoretical throughput of 65,000 transactions per second with a finality of 500ms. Solana experienced phenomenal growth during 2021 due to investors seeing the network’s potential and status as a hub for NFT development.

Solana offers much lower entrance costs than the expensive gas fees on Ethereum’s network, which has worked to its advantage and led to a rapidly expanding user base. Compared to other platforms, Solana transactions cost an average of $0.00025, which is low. Because of its low prices and quick transaction times, Solana attracts people from all over the world.

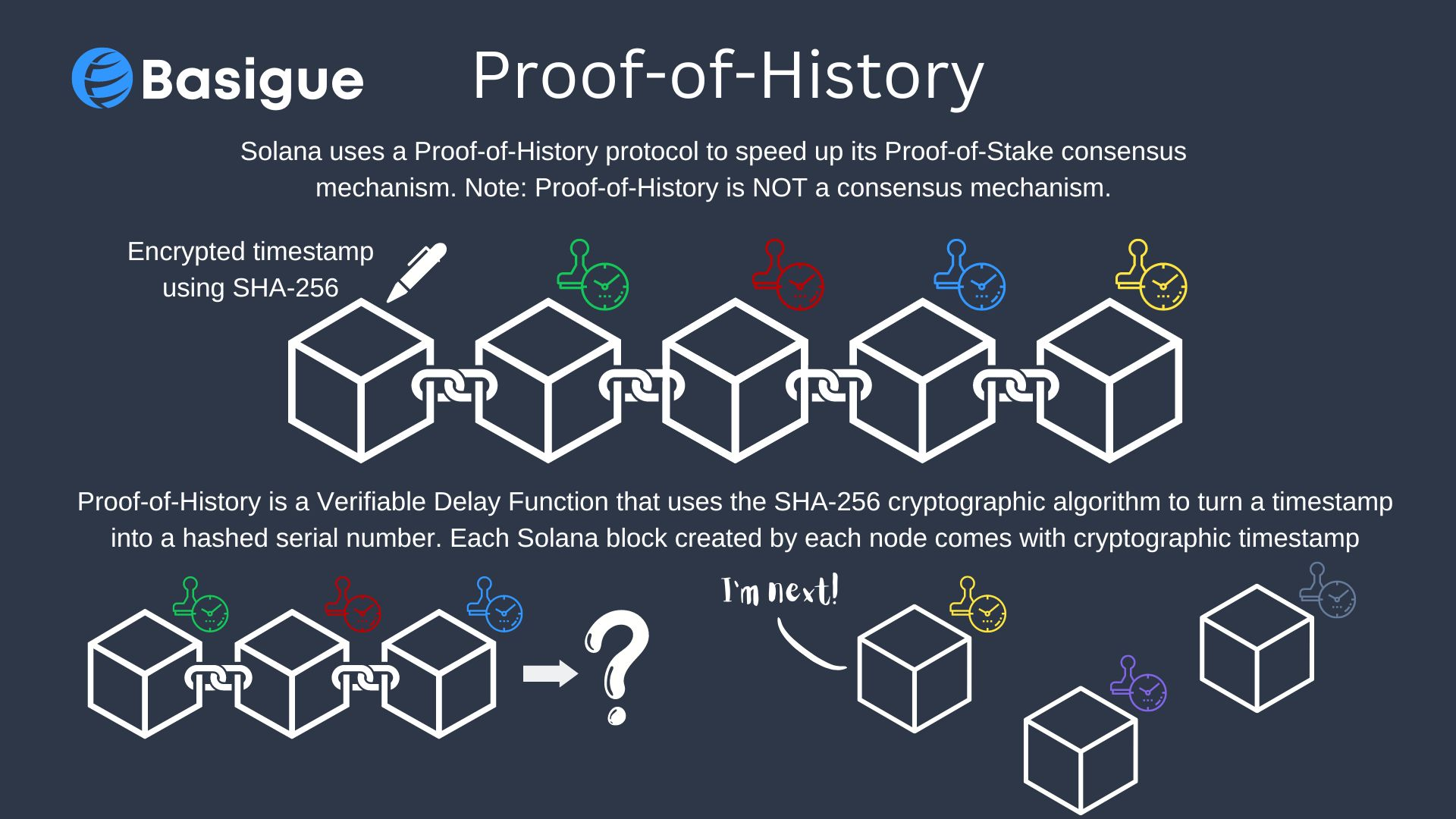

Solana’s signature “proof-of-history” method and a revolutionary proof-of-stake architecture combine to form its consensus process.

How does Solana work?

Solana differs from other platforms; instead of adding each block to the blockchain, it handles cryptocurrency transactions as they happen. This allows Solana to offer dApps high levels of performance on its platform.

Solana uses a modified Proof-of-Stake mechanism known as the Tower BFT (Tower Byzantine Fault Tolerance). The Tower BFT combines the Practical Byzantine Fault Tolerance (pBFT) with the Proof-of-History time-based protocol.

A pBFT system’s nodes are arranged in sequential order, with one serving as the leader and the rest serving as backup nodes. All nodes in the system interact with one another with the objective that all trustworthy nodes will use the majority rule to agree on the system’s current state. A pBFT system allows for a distributed network to reach consensus as long as less than one-third of the nodes are malicious.

Proof of History is not a consensus mechanism, but rather a high-frequency Verifiable Delay Function, or simply put, a universal cryptographic clock placed in all nodes to allow the next node in the queue to know when to produce a block.

The PoH protocol assigns a cryptographic timestamp to each of the transactions using the SHA-256 cryptographic algorithm, so as to “keep time” according to a unique and artificial reference system. The PoH algorithm permits transactions to be processed as they come in rather than organizing each transaction block by block, thus speeding up the process.

Higher scalability, lower gas fee, and more reliable platforms for dApps are made possible by Solana’s algorithm. Its network architecture enables decentralized exchanges, cloud storage, gaming, and stablecoins.

Potential concerns

In PoH, Solana employs a specific protocol and provides several alternatives to numerous current blockchain-related problems. Solana, however, could give rise to particular worries.

Limited decentralization

Decentralization is the guiding philosophy of cryptocurrencies and blockchains. The main goal of the crypto ecosystem is to eliminate entities with significant control over blockchains, which prevents power abuse and outside interference in cryptocurrencies.

One key feature distinguishing Solana from a significant rival like Ethereum is decentralization. Decentralized network ETH previously used a PoW mechanism, but it has switched to a PoS protocol during The Merge on Sep. 15, 2022.

Validators must independently verify new transactions and keep track of the ledger’s current state. In contrast, Solana is more centralized. Solana presently has more than 3400 validators spread over six continents, according to the validator health report for August 2022.

The “Nakamoto coefficient” for Solana is 31. This measure represents the bare minimum of validators necessary to undermine the network consensus, typically considered 33.4% of the voting power.

The top 100 Solana SOL holders alone are said to control 30.81% of the overall supply, despite there being 9 million Solana SOL holders. The research remarked that none of the big data centers hosting Solana nodes ever comes close to holding more than 33% of the active stake.

Geographically, just three nations—Germany, the United States, and Ireland—combine for just over 50% of Solana’s stake.

The significant amount of CPU power required to run a node is another factor used to argue that Solana is centralized. This requirement of high CPU power indicates that it is less practical for the typical user. Additionally, owning one can be costly, depending on the kind of node you want to run.

Downtime

Outages have caused some problems in Solana. Following a server outage in May 2022, the process of new blocks stopped, and the Solana Foundation had to advise validators to restart their machines. After more than four hours, the validators completed the cluster restart, allowing Solana to continue regular operations. During the interruption, there were 975 million uncompleted transactions.

In September 2021, Solana encountered a similar outage because of “resource strain” on its network. Due to numerous computational transactions, the platform’s activities slowed down again in January 2022.

Solana’s success

Solana is still a widely used platform despite some issues like downtime.

It is one of the top 10 cryptocurrencies worldwide and has seen growth in both the number of active developers and market cap. At the time of writing, Solana has a market cap of about $12.5 billion and a supply currently in the circulation of about 349 million SOL.

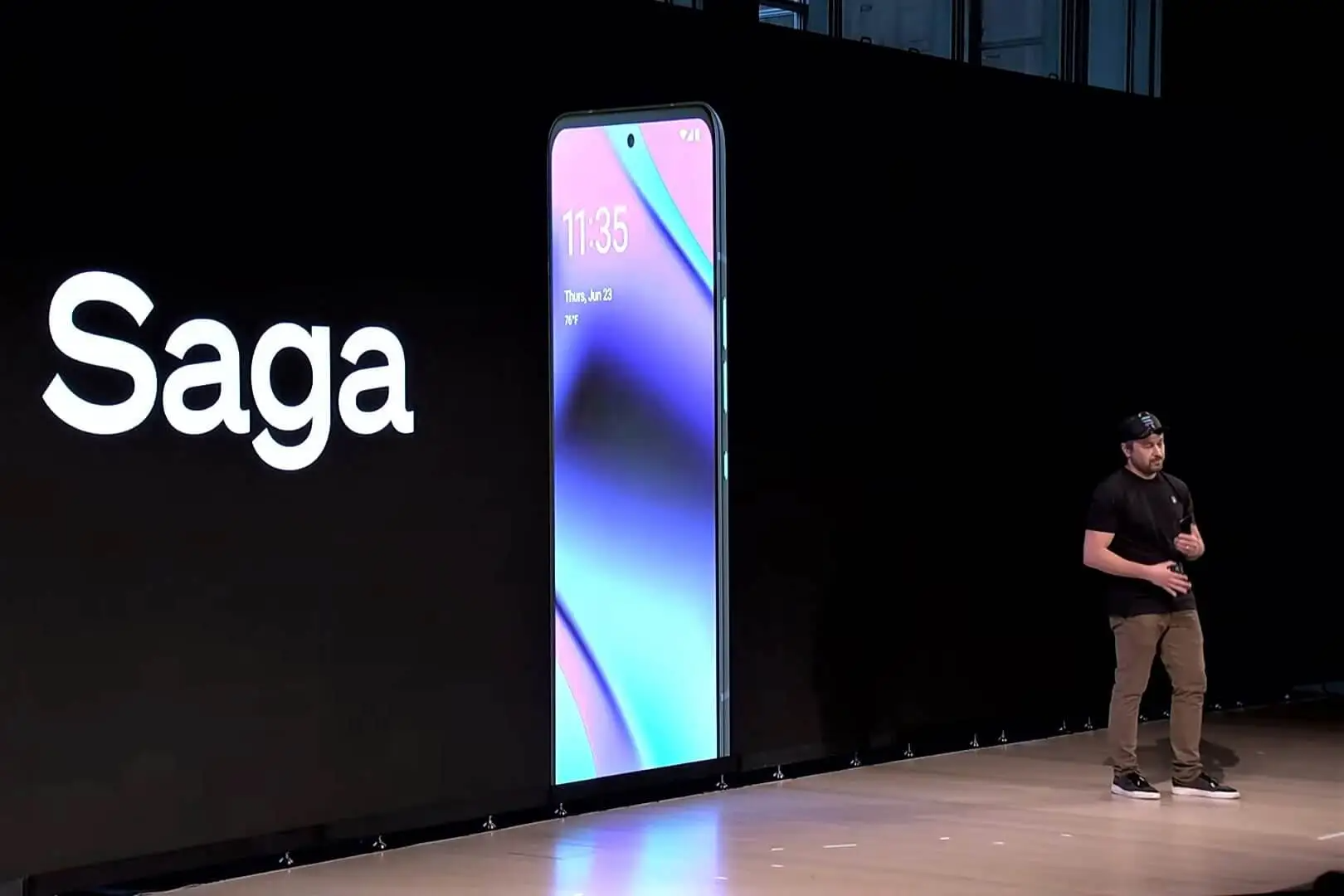

Additionally, Solana intends to introduce its line of mobile phones called Saga in late 2022. These phones would have the most recent Snapdragon 8+ Gen 1 CPUs, 12 gigabytes of RAM, 512 gigabytes of internal storage, and additional security measures tailored exclusively for bitcoin transactions and services. The Saga phones will run Android Operating systems that include built-in Web3 support. Yakovenko reaffirmed Solana’s desire to make Saga phones a hub for the administration and exchange of digital assets.

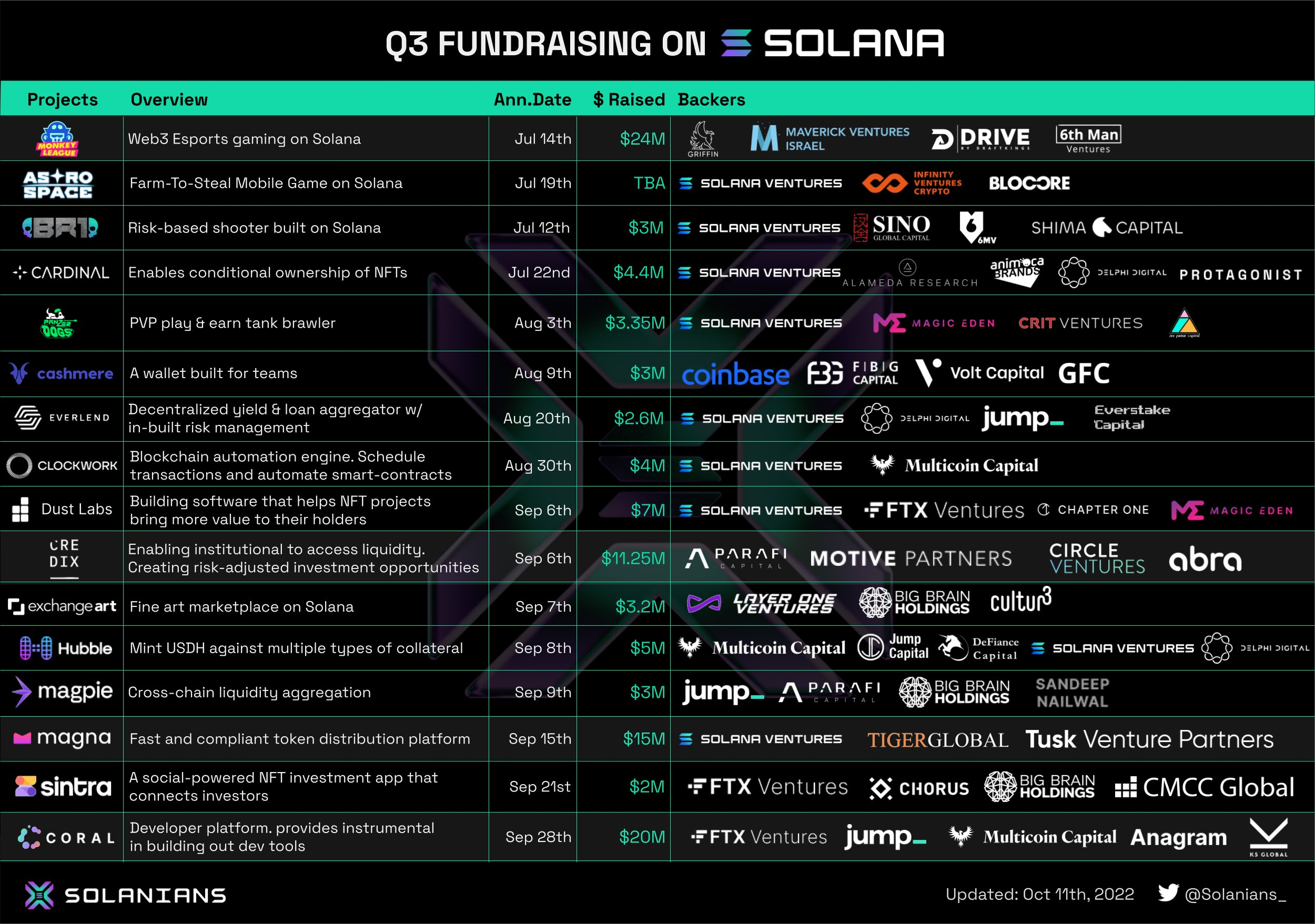

Solana DeFi protocols in Web3 games, NFT marketplaces, and developer tools have raised over $110 million in venture capital funds in the third quarter of 2022, from serious backers such as Coinbase and Solana Ventures just to name a few.

Comparing Avalanche vs Solana

All blockchains, including Solana and Avalanche seek to address the most problematic predicament of a DeFi ecosystem, finding the sweet spot in balancing between decentralization, security, and being scalable. A blockchain cannot have too much of one characteristic without sacrificing the others.

Since we have already gone into the details of Avalanche and Solana individually, we will now compare the core characteristics of Avalanche vs Solana and how they tackle the longstanding trilemma of any DeFi ecosystem.

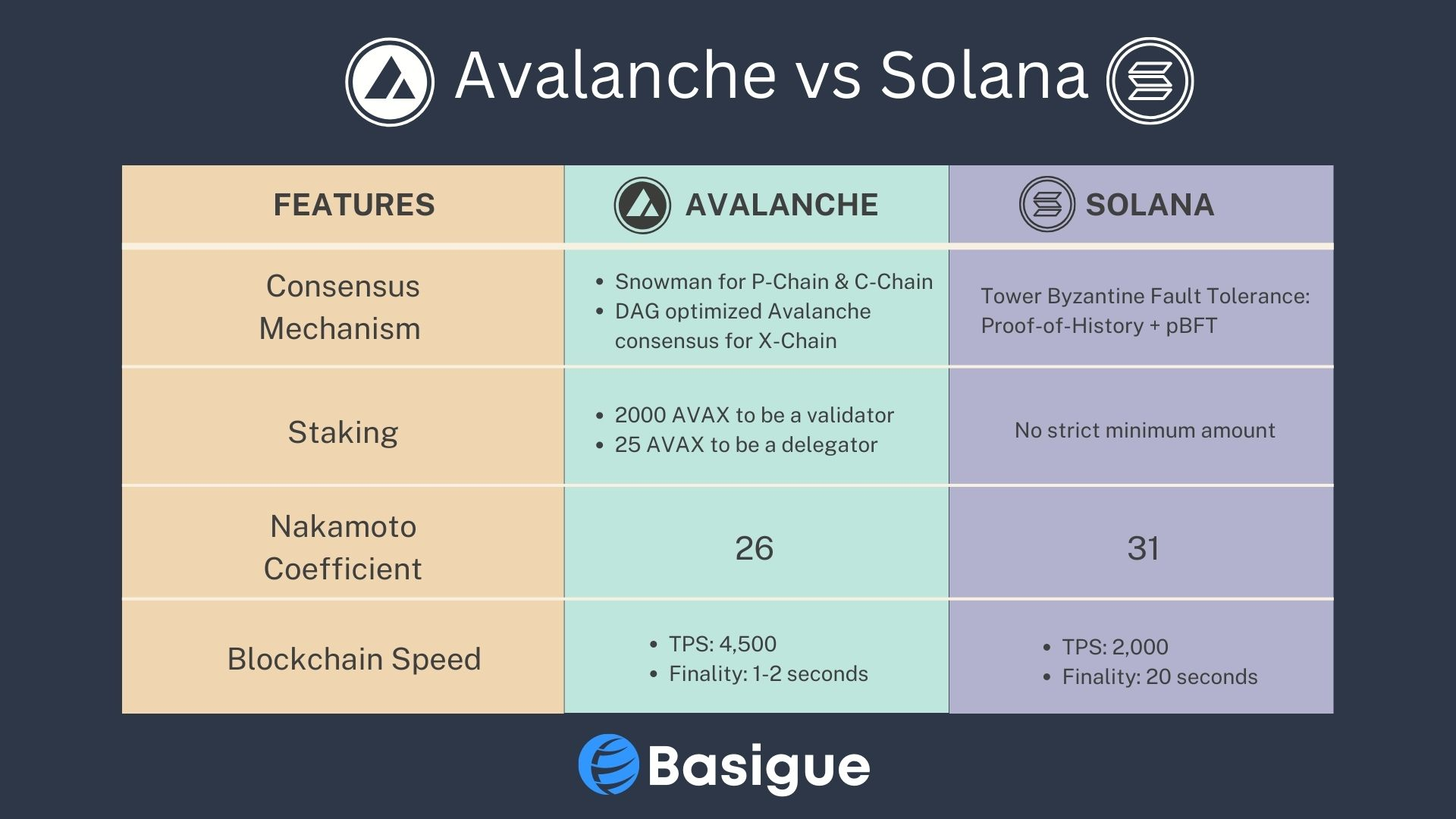

Consensus Mechanism for Scalability – Tower BFT vs Snowball

Both Avalanche and Solana utilize variations of Proof-of-Stake: Solana with Tower BFT and Avalanche with Snowball. In both mechanisms, the staking is required to become a validator.

Avalanche uses the Snowball protocol for its consensus mechanism. Each node periodically and randomly polls a certain number of other nodes, adopting the same consensus reached by the majority. In most cases, using this technique will result in the network agreeing on its current state.

Snowball has great potential to be scalable. As the network’s users increase, the number of consensus messages disseminated stays the same. Nodes will only query a maximum of 20 nodes each time.

Solana, on the other hand, uses the Tower BFT protocol, which combines the Proof-of-History protocol with the Practical Byzantine Fault Tolerance (pBFT) mechanism. Using a form of “cryptographic clock” essentially gives the blockchain a special time reference, accelerating the transaction validation process. A combination of these two mechanisms allows for scalability, decentralization as well as the speed of transactions.

Both Solana and Avalanche use innovative methods to agree on the state of the blockchain; this allows the network to be scalable, secure, and have a high network speed.

Which is easier to become a validator?

Every blockchain has its criteria for becoming a validator. The easier it is to become a validator, the greater the likelihood of greater decentralization for the platform.

Creating an Avalanche validation node requires a considerable amount of stake, 2000 AVAX to be precise, which is around US$35,000 at the time of writing.

Not everyone is prepared to freeze up that amount of capital. However, you can choose to become a delegator instead of a validator, which only requires you to delegate a minimum of 25 AVAX to a validator as a delegate. You will still receive staking rewards equivalent to your delegated amount with a small fee paid to the validator.

The great thing about staking on Avalanche is that it requires minimal computation power and internet connectivity to meet the standards for staking.

Solana is quite the opposite of Avalanche in becoming a validator. You only require a fraction of SOL to become a validator, but it requires much more computation power.

Therefore, regarding the ease of becoming a validator for Avalanche vs Solana, it is low staking costs for Solana but low energy consumption for Avalanche.

Which is more decentralized?

How decentralized a platform is does not depend on how many validators there are, but on whether a small group of people controls the majority of the network.

The way to ascertain how decentralized a blockchain is is by its Nakamoto Coefficient, the smallest number of validators with a stake of 33% of the total staked funds. The larger the Nakamoto Coefficient, the more decentralized the blockchain is.

As it stands, Solana has a Nakamoto Coefficient of 31, whereas this number is 26 for Avalanche. Therefore in the battle of decentralization between Avalanche vs Solana, Solana wins this bout in the decentralization battle between Avalanche and Solana.

Which blockchain is faster?

Regarding platform speed for Avalanche vs. Solana, which is faster?

Two factors contribute to the speed of a blockchain – The number of transactions per second (TPS) and finality. Transactions per second refer to the number of transactions a network can handle, and finality refers to the time taken for a blockchain to confirm a transaction and render it immutable.

Solana boasts an extremely high theoretical transactions per second of 65,000 with a finality of 500ms, but it is prone to outages, suffering almost 6 major outages in 2022, causing a lot of downtimes. Practically, Solana’s TPS is around 2,000 with a finality of more than 20 seconds.

On the other hand, Avalanche has a TPS of around 4,500 but a finality of 1-2 seconds, which is a near-instant finality.

Due to Solana’s constant outages and Avalanche’s near-instant finality, Avalanche is considered the faster blockchain between Solana and Avalanche.